Corporate Social Responsibility

This Corporate Social Responsibility Policy shall be called the Premier Explosives Limited -Corporate Social Responsibility Policy, (hereinafter referred as the “CSR Policy”).

This policy shall be read in line with the provisions of section 135 of the Companies Act, 2013, Companies (Corporate Social Responsibility Policy) Rules, 2014 and such other rules, regulations, circulars and notifications as may be applicable and as amended from time to time. Effective Date:This policy shall be effective from the financial year beginning 1st April, 2014.

Definitions:- “Act” means the Companies Act, 2013.

- “Board” means Board of Directors of the Company.

- “Committee” means Corporate Social Responsibility Committee of the Company as constituted or reconstituted by the Board.

- “Company” means Premier Explosives Limited.

The Corporate Social Responsibility Committee has been constituted at the Meeting of the Board of Directors held on 31st October, 2013 in accordance with the provisions of section 135 of the Companies Act, 2013.

The duties, functions and scope of the Committee:

- formulate and recommend to the Board, a Corporate Social Responsibility Policy which shall indicate the activities to be undertaken by the Company in the areas or subject as specified in Schedule VII of the Act read along with the rules made thereunder.

- recommend the amount of expenditure to be incurred on the activities referred to in clause (a) and

- monitor the Corporate Social Responsibility Policy of the company from time to time.

Purpose of the Policy:

The following are the broad purposes of this

policy:

- To define the kind of projects/activities that will come under the ambit of CSR;

- To identify broad areas of activities in which the company will undertake projects;

- To execute and monitor CSR projects and to identify partners, if required for implementation of the CSR activities.

Objectives:

Activities for social inclusive development

The Company shall undertake activities for economic and social development of communities, particularly in the vicinity of the areas where the facilities of the Company are located. Such activities may include:

- Eradicating hunger, poverty and malnutrition, promoting health care including preventive health care and sanitation and making available safe drinking water;

- Promoting education, including special education and employment enhancing vocation skills especially among children, women, elderly, and the differently abled and livelihood enhancement projects;

- Promoting gender equality, empowering women, setting up homes and hostels for women and orphans; setting up old age homes, day care centers and such other facilities for senior citizens and measures for reducing inequalities faced by socially and economically backward groups;

- Ensuring environmental sustainability, ecological balance, protection of flora and fauna, animal welfare, agroforestry, conservation of natural resources and maintaining quality of soil, air and water;

- Protection of national heritage, art and culture including restoration of buildings and sites of historical importance and works of art; setting up public libraries; promotion and development of traditional arts and handicrafts:

- Measures for the benefit of armed forces veterans, war widows and their dependents;

- Training to promote rural sports, nationally recognised sports, paralympic sports and Olympic sports;

- Contribution to the Prime Minister's National Relief Fund or Prime Minister's Citizen Assistance and Relief in Emergency Situations Fund (PM CARES Fund) or any other fund set up by the Central Government for socio-economic development and relief and welfare of the Scheduled Castes, the Scheduled Tribes, other backward classes, minorities and women;

- Contributions to incubators or research and development projects in the field of science, technology, engineering and medicine, funded by the Central Government or State Government or Public Sector Undertaking or any agency of the Central Government or State Government.

- Contributions to public funded Universities; Indian Institute of Technology (IITs); National Laboratories and autonomous bodies established under Department of Atomic Energy (DAE); Department of Biotechnology (DBT); Department of Science and Technology (DST); Department of Pharmaceuticals; Ministry of Ayurveda, Yoga and Naturopathy, Unani, Siddha and Homoeopathy (AYUSH); Ministry of Electronics and Information Technology and other bodies, namely Defense Research and Development Organisation (DRDO), Indian Council of Agricultural Research (ICAR); Indian Council of Medical Research (ICMR) and Council of Scientific and Industrial Research (CSIR), engaged in conducting research in science, technology, engineering and medicine aimed at promoting Sustainable Development Goals (SDGs).

- Rural development projects.

- Slum Area Development Projects.

- Disaster Management, including relief, rehabilitation and reconstruction activities.

The following activities and the amount, if any spent, shall not be considered as CSR activities and shall not be included in computing the CSR expenditure.

- One-off events such as marathons/awards/charitable contribution/advertisement/sponsorships of TV programmes etc., would not be qualified as part of CSR expenditure.

- Expenses incurred for the fulfillment of any Act/Statue of regulations (such as Labour Laws, Land and Acquisition Act etc.,) applicable to the Company would not count as CSR expenditure under the Companies Act.

- All activities undertaken in pursuance of normal course of business.

- All activitiesor programmes undertakento benefit only the employees of the company and their families.

- Contribution of any amount directly or indirectly to any political party under section 182 of the Act.

- Any activity undertaken by the company outside India except for training of Indian sports personnel representing any State or Union territory at national level or India at International level.

- Activities supported by the companies on sponsorship basis for deriving marketing benefits for its products or services.

The CSR Committee shall be authorised to consider CSR activities within the CSR Rules framed by the Ministry of Corporate Affairs not falling in the above list. All activities under the CSR activities should be environment friendly and should be in the interest of the society and the local population where the Company’s units are situated. Any activity proposed to be undertaken as a CSR initiative, but not outlined in this Policy, may be undertaken only with the specific pre-approval from the CSR Committee.

Information dissemination:

The Company’s CSR activities, Composition of

CSR Committee, CSR Policy shall be placed on website of the Company.

Corporate Social ResponsibilityCommittee (CSR Committee):

The Committee

shall be fully responsible for the monitoring and review of the implementation of this policy as

per guidelines laid down from time to time. The Corporate Social Responsibility Committee shall

provide recommendations as and when it deems necessary to the Board so as to amend/modify/revise

the CSR policy to be consistent with the needs of the Company and applicable statutory

requirement.

Source of Fund:

For achieving its CSR objectives through implementation of

meaningful and sustainable CSR programmes, the Company shall endeavor to allocate the following

as its annual CSR corpus.

- 2% of average net profits made during the three immediately preceding financial years as prescribed under the Companies Act, 2013, and the Rules.

- Any income arising therefrom and

- Surplus arising out of CSR activities

It is clarified that surplus arising out of CSR projects/programs shall not form part of business profits of the Company and shall be ploughed back into the same project or transfer to unspent CSR account and be spent within a period of 6 months of the expiry of year.

Mode of implementation:

CSR programs, project or activities, will be

implemented through one or more of the following methods:

- Directly by the Company.

- In collaboration with other organizations, if such organisation falls under the Rule 4 of the Companies (CSR Policy) Amendment Rules, 2021.

- a company established under section 8 of the Act or a registered public trust or a registered society, registered under section 12A and 80G of the Income Tax act, 1961, established by the company, either singly or along with any other company.

- a Company establishedunder section 8 of the Act or a registered trust or a registered society, established by the Central Government or State Government; or

- any entity established under an Act of Parliament or a State legislature; or

- a company establishedunder section 8 of the Act or a registered public trust or a registered society, registered under section 12A and 80G of the income tax act, 1961 and having an established track record of at least three years in undertaking similar activities.

Spending limits:

All the expenditure relating to CSR shall be pre-approved by the CSR Committee. The Managing Director, Director-Operations and CFO shall jointly monitor the utilization of funds for the purposes set forth.

The Board shall ensure that the administrative overheads shall not exceed five percent of total CSR expenditure of the company for the financial year.

If the Company fails to spend amount as per Section 135(5) of the Companies Act, 2013, the board shall, specify the reasons for not spending the amount in the Directors Report.

If the Company spends an amount in excess of the requirements provided under Section 135(5) of the Companies Act, 2013,, the Company may set off such excess amount against the requirement to spend up to immediately succeeding 3 financial years and in such manner, as may be prescribed.

CSR Reporting:

If Company’s average CSR obligations is 10 crore rupees or more in the 3 immediately preceding FYs, shall undertake impact assessment, through an independent agency, of the CSR projects having outlays of 1 crore rupees or more, completed a year ago.

Impact assessment reports be placed before Board and annexed to the annual report on CSR.

Transfer of unspent CSR amount:

The Company shall transfer the Unspent CSR amount to fund as specified in Schedule VII.

Upkeep and Maintenance of assets created:

Maintenance of assets created under CSR would be the responsibility of the Company. Before any Capital investment is made, an undertaking would be taken from the representative of local community that they would be responsible for maintenance of the assets and the disposal of such assets shall not be made without the prior approval of the CSR Committee.

Documentation of CSR Activities:

It shall be the duty of the Company to keep all documents pertaining to the activities undertaken under CSR policy and submit the annual report to the CSR committee. The CSR activities will be reflected in the Annual Report and Accounts of the Company under (CSR). Revised format for the Annual Report on CSR activities to be included in Board’s Report for FY 2020-21 onwards.

Amendments:

The Board of Directors on its own and / or as per the recommendations of the CSR Committee may amend this Policy as and when deemed fit. Any or all provisions of this Policy would be subject to revision / amendment in accordance with the Rules, Regulations, Notifications etc., on the subject as may be issued by relevant statutory authorities, from time to time.

In case of any amendment(s), clarification(s), circular(s) etc., issued by the relevant authorities, which make the provisions laid down under this Policy inconsistent with such amendment(s),clarification(s), circular(s) etc., then such amendment(s),clarification(s), circular(s) etc., shall prevail upon the provisions hereunder and this Policy shall stand amended accordingly from the effective date as laid down under such amendment(s),clarification(s), circular(s) etc.,

Policy-Whistle Blowing

Vigil Mechanism / Whistleblower Policy

Policy

The company shall enable its stakeholders, including

employees and directors, to freely communicate their concerns about illegal or unethical

practices by establishing an effective Vigil Mechanism

This Vigil Mechanism Policy is a framework that ensures carrying on the affairs of the

company in a fair and transparent manner by adopting highest standards of professionalism,

honesty, ethical, moral and legal conduct.

Objective

- To establish procedures for the submission of complaints or concerns about illegal, immoral, illegitimate or unethical practices to the Company

- To provide necessary safeguard for protection of employees and other stakeholders from reprisal or victimization

Scope

This Policy applies to all its stakeholders including Directors, Employees (part/full time,

temporary and contract)

Legislation

Clause 177 (9) of the Companies Act, 2013 as

well as Clause 49 of the Listing Agreement mandate certain classes of companies to constitute

a vigil mechanism. Being a listed company these provisions are applicable to Premier

Explosives Limited.

Definitions

- Audit Committee shall mean a Committee of Board of Directors of the Company, constituted in accordance with provisions of Section 177 of Companies Act, 2013 read with Clause 49 of Listing Agreement entered into by the Company with Stock Exchanges.

- Code means Code of Conduct of Premier Explosives Limited.

- Director means every Director of the Company, past or present.

- Protected Disclosure means any communication made in good faith that discloses or demonstrates information that may evidence unethical or improper activity.

- Unethical and improper practices shall include –

- An act which does not conform to approved standard of social and professional behaviour

- An act which leads to unethical business practices

- Improper or unethical conduct

- Breach of etiquette or morally offensive behavior

- Incorrect financial reporting

- An act which is not in line with applicable company policy

- An unlawful act, etc.

- Good Faith

An employee or other stakeholder shall be deemed to be communicating in ‘good faith’ if there is a reasonable basis for reporting unethical and improper practices or any other alleged wrongful conduct.

Good Faith shall be deemed lacking when the employee or other stakeholder does not have personal knowledge of a fact or reasonable inferences about the unethical and improper practices or alleged wrongful conduct. - Subject means a person or group of persons against or in relation to whom a Protected Disclosure is made or evidence gathered during the course of an investigation.

- Whistleblower is a stakeholder, including an employee or a director, who reveals about any unethical or improper practices carried on by the Company and communicates to reporting authority.

- Reporting authority:

For employees – employee’s supervisor, supervisor’s supervisor and Audit Committee

For other stakeholders – Audit committee

Procedure

- Any stakeholder can submit his Protected Disclosure (complaint / report) directly to any

of the reporting authorities about any suspected violation of law, Code of Conduct,

ethics, etc.

Protected Disclosure may be in writing clearly mentioning the name and address of whistleblower. The whistleblower has the option not to disclose his identity.

An employee can submit his complaint / report to his immediate supervisor, next level supervisor or Audit Committee. Other stakeholders shall submit the complaint /report to Audit Committee.

Protected Disclosure (complaint / report) to the Audit Committee shall be addressed to:

Chairman - Audit Committee

Premier Explosives Limited

“Premier House” 11-Ishaqu Colony (Near AOC Centre)

Secunderabad – 500 015

- Supervisors receiving the Protected Disclosures shall forward them to Audit Committee within 10 days of receiving it, along with the comments of Supervisors

- Audit Committee, upon receipt of a report, shall consider the merits of reported matter investigate and take necessary action within 90 days and update the Board accordingly.

- Reporting authorities shall maintain confidentiality of the whistle blowers and witnesses providing the information during the course of investigation.

- Reporting authorities and Board shall provide adequate safeguard against victimization of the whistleblowers and witnesses. However, any abuse of this protection shall warrant disciplinary action against non-genuine whistleblowers.

- The company shall inform its stakeholders about the establishment of whistle blowing mechanism and also shall disclose about it on its website and in the Board’s report.

Policy-Related Parties

Related Parties Transactions Policy

PREAMBLE

This policy on related party transactions (“Related Party Transactions Policy” or RPT

Policy”) has been formulated, on the recommendation of the Audit Committee, in pursuance of

Regulation 23 of the Securities and Exchange Board of India (Listing Obligations and

Disclosure Requirements) Regulations, 2015 (“Listing Regulations”) and approved by the Board

of Directors.

The RPT Policy is to ensure the proper approval, regulation and reporting of

transactions between the Company and its related parties.

DEFINITIONS

“Audit Committee” means Committee of Board of Directors of the Company.

“Board” means Board of Directors of the Company.

“Company” means “Premier Explosives Limited.

“Related Party” means an entity which:

- is a related party under Section 2(76) of the Companies Act, 2013; or

- is a related party under the applicable Accounting Standards. Provided that:

- any person or entity forming a part of the promoter or promoter group of the listed entity; or

- any person or any entity, holding equity shares:

- of 20% or more; or

- of 10% or more, with effect from April 1, 2023;

in the listed entity either directly or on a beneficial interest basis as provided under section 89 of the Companies Act, 2013, at any time, during the immediate preceding financial year; shall be deemed to be a related party:”

“Related Party Transaction” means a transaction involving a transfer of resources, services or obligations between:

- a listed entity or any of its subsidiaries on one hand and a related party of the listed entity or any of its subsidiaries on the other hand; or

- a listed entity or any of its subsidiaries on one hand, and any other person or entity on the other hand, the purpose and effect of which is to benefit a related party of the listed entity or any of its subsidiaries, with effect from April 1, 2023;

regardless of whether a price is charged and a “transaction” with a related party shall be construed to include a single transaction or a group of transactions in a contract:

Provided that the following shall not be a related party transaction:

- the issue of specified securities on a preferential basis, subject to compliance of the requirements under the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018;

- the following corporate actions by the listed entity which are uniformly applicable/ offered to all shareholders in proportion to their shareholding:

- payment of dividend;

- sub-division or consolidation of securities;

- issuance of securities by way of a rights issue or a bonus issue; and

- buy-back of securities.

- acceptance of fixed deposits by banks/Non-Banking Finance Companies at the terms uniformly applicable/offered to all shareholders/public, subject to disclosure of the same along with the disclosure of related party transactions every six months to the stock exchange(s), in the format as specified by the Board:

“Material Related Party Transaction” means

- a transaction with a related party if the transaction(s) to be entered into individually or

taken together with previous transactions during a financial year, exceeds rupees one

thousand crore or ten per cent of the annual consolidated turnover of the listed entity as

per the last audited financial statements of the listed entity, whichever is lower.

“Material Modifications” means:

- Modification to an existing RPT having variance of 20% of the existing sanctioned limit.

- Modification resulting into not meeting arm’s length testing.

TRANSACTIONS COVERED UNDER THE POLICY

Following transactions entered with a Related Party are considered as Related PartyTransactions:

- sale, purchase or supply of any goods or materials; any selling or otherwise disposing of, or buying, property of kind;

- leasing of property of any kind;

- availing or rendering of any services;

- appointment of any agent for purchase or sale of goods, materials, services or property;

- such related party's appointment to any office or place of profit in the company, its subsidiarycompany or associate company; and

- underwriting the subscription of any securities or derivatives thereof, of the company.

- transfer of resources, services or obligations between:

- a listed entity or any of its subsidiaries on one hand and a related party of the listed entity or any of its subsidiaries on the other hand; or

- a listed entity or any of its subsidiaries on one hand and any other person or entity on the other hand, the purpose and effect of which is to benefit a related party of the listed entity or any of its subsidiaries, with effect from April 1, 2023;

regardless of whether a price is charged and a “transaction” with a related party shall be construed to include a single transaction or a group of transactions in a contract:

Provided that the following shall not be a related party transaction:

- the issue of specified securities on a preferential basis, subject to compliance of the requirements under the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018;

- the following corporate actions by the listed entity which are uniformly applicable/offered to all shareholders in proportion to their shareholding:

- payment of dividend

- sub-division or consolidated of securities;

- issuance of securities by way of a rights issue or a bonus issue; and

- buy-back of securities.

IDENTIFICATION AND APPROVAL PROCESS

4.1 Identification of potential Related Party Transactions

Each director and Key Managerial Personnel is responsible for providing notice to the Board or Audit Committee of any potential Related Party Transaction involving him or her or his or her relative, including any additional information about the transaction that the Board / Audit Committee may reasonably request. The Audit Committee will determine whether the transaction does, in fact, constitute a Related Party Transaction requiring compliance with this policy.

The Finance & Accounts Dept. shall ensure that no related party transaction are processed without the approval of the Audit Committee and it shall be duty of the Finance & Accounts Dept.to communicate all related party transactions in advance to the Company Secretary to enable to take requisite approvals.

The Company strongly prefers to receive such notice of any potential related party transaction well in advance so that the Audit Committee / Board has adequate time to obtain and review information about the proposed transaction.

4.2 Approval of Audit CommitteeAll Related Party Transactions and subsequent Material Modifications shall require prior approval of the Audit Committee of the company. Provided that only those members of the audit committee, who are independent directors, shall approve related party transactions.

Prior approval of Audit Committee of Listed Company where subsidiary of the listed company is party but the Company is not party.

- a related party transaction to which the subsidiary of a Company is a party but the Company is not a party, shall require prior approval of the Audit Committee of the Company if the value of such transaction whether entered into individually or taken together with previous transactions during a financial year exceeds ten per cent of the annual consolidated turnover, as per the last audited financial statements of the Company.

- with effect from April 1, 2023, a related party transaction to which the subsidiary of a Company is a party but the Company is not a party, shall require prior approval of the Audit Committee of the Company if the value of such transaction whether entered into individually or taken together with previous transactions during a financial year exceeds ten per cent of the annual consolidated turnover, as per the last audited financial statements of the subsidiary.

- prior approval of the audit committee of the listed entity shall not be required for a related party transaction to which the listed subsidiary is a party but the listed entity is not a party, if regulation 23 and sub-regulation (2) of regulation 15 of these regulations are applicable to such listed subsidiary.

xplanation: For related party transactions of unlisted subsidiaries of a listed subsidiary as referred to in (d) above, the prior approval of audit committee of the listed subsidiary shall suffice.

However, the Audit Committee may grant omnibus approval for related party transactions

proposed to be entered into by the Company subject to the following conditions:

- The Audit Committee shall, in line with this RPT Policy, grant the omnibus approval on related party transactions of the Company in respect of transactions which are repetitive in nature.

- The Audit Committee shall satisfy itself the need for such omnibus approval and that such approval is in the interest of the Company.

- Such omnibus approval shall specify (i) the name/s of the related party, nature of transaction, period of transaction, maximum amount of transaction that can be entered into, (ii) the indicative base price/ current contracted price and the formula for variation in the price, if any and (iii) such other conditions as the Audit Committee may deem fit.

- d. Such omnibus approval shall be valid for a period not exceeding one year and shall require fresh approvals after the expiry of one year.

- e. Omnibus approval shall not be made for transactions in respect of selling or disposing of the undertaking of the Company.

Provided that where the need for Related Party Transactions cannot be foreseen and aforesaid details are not available, Audit committee may grant omnibus approval for such transactions subject to their value not exceeding Rs.1 crore per transaction.

4.3 Approval of Board of Directors

All Related Party Transactions, which are not in ordinary course of business / not at arm’s length, shall require prior approval of the Board of Directors. Where any Director of the Company is interested in any contract or arrangement with a Related Party, such Director shall not be present at the meeting during discussions on the subject matter of the resolution relating to such contract or arrangement.

4.4 Approval of Shareholders

Related Party Transactions not in ordinary course of business or not at arm’s length, shall require prior approval of the shareholders through an Ordinary resolution, if they exceed the threshold limits prescribed under Section 188 of the Companies Act, 2013 read with Rules made thereunder. No Related Party shall vote to approve such resolutions.

All Material Related Party Transactions and subsequent material modifications, irrespective of whether they are in the ordinary course of business and at arm’s length shall require prior approval of the shareholders through an Ordinary resolution and No Related Party shall vote to approve such resolutions, whether the entity is a party to the particular transaction or not.

Provided that prior approval of the shareholders of a listed entity shall not be required for a related party transaction to which the listed subsidiary is a party but the listed entity is not a party, if regulation 23 and sub-regulation (2) of regulation 15 of these regulations are applicable to such listed subsidiary.

Explanation: for related party transaction of unlisted subsidiary of a listed subsidiary as referred above, the prior approval of the shareholders of the listed subsidiary shall suffice.

Provided further that the approval of shareholders shall not be required in respect of a resolution plan approved under section 31 of the Insolvency Code, subject to the event being disclosed to the recognized stock exchanges within 1 day of the resolution plan being approved.

The requirement of approval of Shareholders is not applicable for the transactions entered into with wholly owned subsidiaries whose accounts are consolidated with the Company and placed before the shareholders at the general meeting for approval.

In case of wholly owned subsidiary, the resolution passed by the Company shall be sufficient for the purpose of entering into the transactions between wholly owned subsidiary and the Company.

The provisions of sub-regulation (2), (3), (4) shall not apply to transactions entered into between two wholly owned subsidiaries of the listed holding company, whose accounts are consolidated with such holding company and placed before the shareholders at the general meeting for approval.

4.5 Related Party Transactions not approved under this Policy

In the event the Company becomes aware of a Related Party Transaction with a Related Party that has not been approved under this Policy prior to its consummation, the matter shall be reviewed by the Audit Committee. The Audit Committee shall consider all of the relevant facts and circumstances regarding the Related Party Transaction, and shall evaluate all options available to the Company, including ratification, revision or termination of the Related Party Transaction. The Committee shall also examine the facts and circumstances pertaining to the failure of reporting such Related Party Transaction to the Committee under this Policy, and shall take any such action it deems appropriate.

In any case, where the Committee determines not to ratify a Related Party Transaction that has already commenced without prior approval of the Audit Committee, the Committee, as appropriate, may direct additional actions including, but not limited to, immediate discontinuation or rescission of the transaction. In connection with any review of a Related Party Transaction, the Committee has authority to modify or waive any procedural requirements of this Policy.

REPORTING OF RELATED PARTY TRANSACTION

The transactions entered into with a related party pursuant to omnibus approval shall be

reported to the Audit Committee on half yearly basis.

The related party transactions on a consolidated basis shall be disclosed to the stock

exchanges in the format as specified by the Board from time to time, and publish the same on

its website.

Provided further that the Company shall make such disclosures every six months within 15 days

from the date of publication of its standalone and consolidated financial results.

Provided further that the Company shall make such disclosures every six months on the date of

publication of its standalone and consolidated financial results with effect from April 1,

2023.

Particulars of contracts / arrangements entered into by the Company with related parties

referred to in Section 188(1) of the Companies Act, 2013, including arm’s length transactions

shall be disclosed on an annual basis as part of Annual Report.

AMENDMENTS & GOVERNING LAW

The Board of Directors on its own and / or as per the recommendations of the Audit Committee

may amend this Policy as and when deemed fit. Any or all provisions of this Policy would be

subject to revision / amendment in accordance with the Rules, Regulations, Notifications

etc., on the subject as may be issued by relevant statutory authorities, from time to

time.

In case of any amendment(s), clarification(s), circular(s) etc., issued by the relevant

authorities, which make the provisions laid down under this Policy inconsistent with such

amendment(s),clarification(s), circular(s) etc., then such amendment(s),clarification(s),

circular(s) etc., shall prevail upon the provisions hereunder and this Policy shall stand

amended accordingly from the effective date as laid down under such

amendment(s),clarification(s), circular(s) etc.,

This Policy shall be governed by the Companies Act, 2013 read with Rules made thereunder, as

may be in force for the time being as well as Regulation 23 of the Securities and Exchange

Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“Listing

Regulations”) or such other Rules / Regulations, as may be notified by SEBI from time to

time.

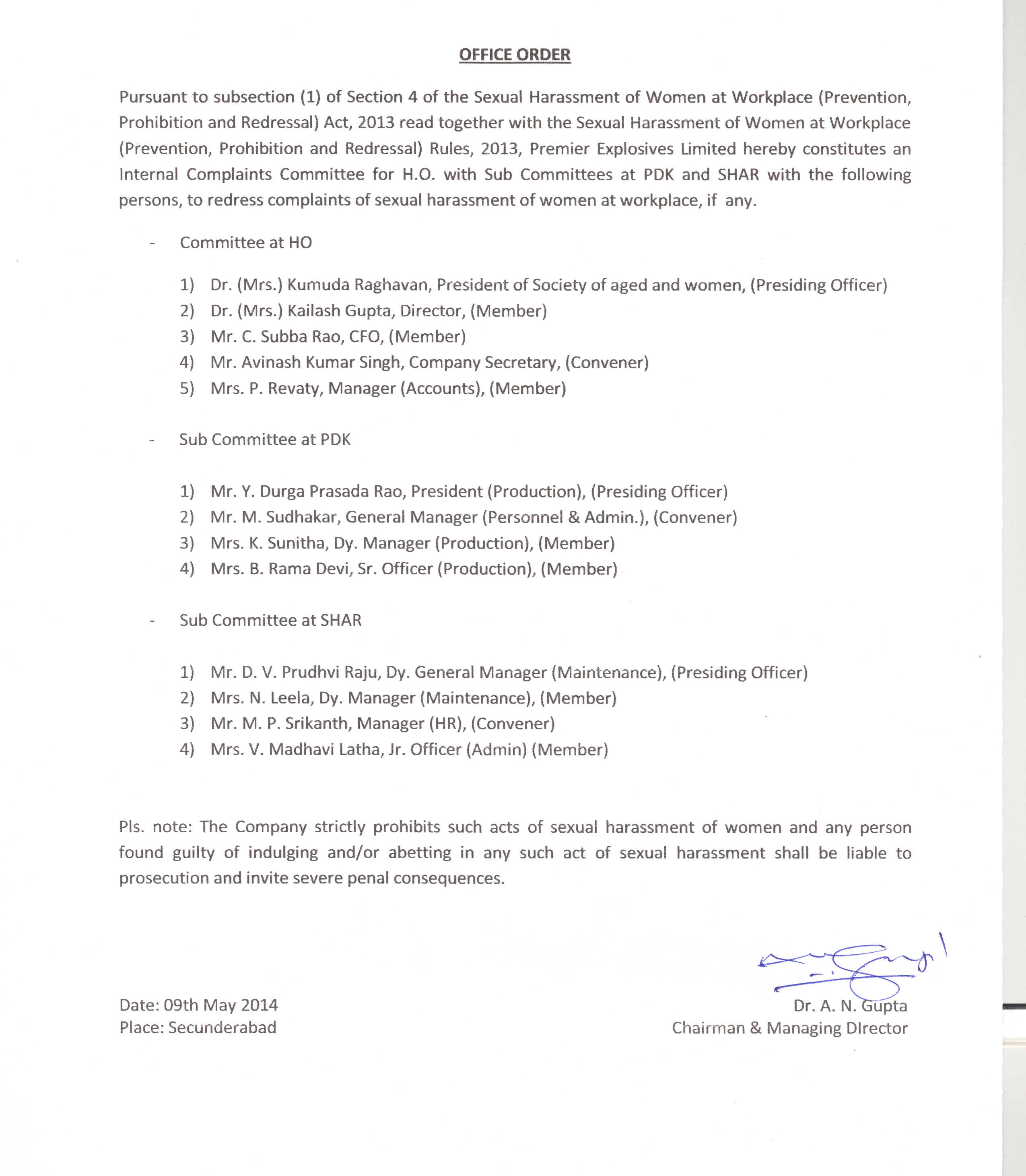

Policy - Nirbhaya Act

Policy - Risk Management

Risk Management Policy

Policy

The company’s Risk Management Policy is a robust mechanism to safeguard its resources and

activities, from various risks that may have adverse impact on achievement of organizational

goals

Background

This policy shall comply with the amended Clause 49 of the Listing Agreement which requires

the company to lay down procedure for risk assessment and procedure for risk

minimization.

"Clause 49 VI (C): The company through its Board of Directors shall constitute a Risk

Management Committee. The Board shall define the roles and responsibilities of the Risk

Management Committee and may delegate monitoring and reviewing of the risk management plan to

the committee and such other functions as it may deem fit. "

Procedure

- Role of the Board

- Board is responsible for framing, implementing and monitoring the risk management policy of the company as well as for reviewing the policy.

- Board would appoint the Risk Management Committee and define the roles and responsibilities of that committee and may delegate the risk management function to the Committee and such other functions as it may deem fit.

- Ensure risk management is integrated into board reporting and annual reporting.

- Role of Risk Management Committee

- Constitution

The Board appoints the committee, comprising of both directors and senior management, chaired by a director.

The first committee shall have the following as its members:- Dr.Amarnath Gupta, CMD (Chairman)

- Mr.T.V.Chowdary Executive Director (Member)

- Mr.Y.Durga Prasad ,President-Production (Member)

- Mr.C.Subba Rao, CFO (Member)

- Meetings and quorum

The committee shall meet at least once in a year.

The quorum of the meeting shall be two members with at least one director. - Responsibility

- Periodically assess risks affecting the business operations and review key leading indicators

- Periodically review the risk management processes and ensure that the company is prudently balancing between risk and reward.

- Coordinate its activities with the Audit Committee in instances where there is any overlap with audit activities (e.g. internal or external audit issue relating to risk management policy or practice).

- Report to the Board with respect to risk management and minimization procedures.

- Constitution

- Risk identification

From own experience and based on knowledge of industry and environment, the company shall make a checklist of various kinds of risks which may include- Internal risks

(internal to the company, generally controllable)- - Handling hazardous chemicals

- - Machine breakdown

- - Technical failure

- - Employee absence

- Strategic risks

(major decisions of the company)- - Investment in new business

- - Development of new product

- External risks

(beyond company borders, generally uncontrollable)- - Environmental

- - Political

- - Force majeure

- - Regulatory

- - Financial: interest rate, scarcity of funding, etc

- Internal risks

- Risk analysis

Analyse the causes and sources of risks

Also anticipate the consequences of risks - Risk assessment

Estimate the magnitude of damage in terms of value

Classify the estimated damage whether it is- - Devastating

- - Major

- - Tolerable

- - Minor

- Risk mitigation

- Risk avoidance

e.g. Avoiding further supplies to a customer who failed to pay for the previous supplies

Risk / reward balance to be kept in mind – avoidance of sales means losing potential profit - Risk transfer to third party

Obtaining insurance cover, hedging the forex exposure, etc. - Risk reduction

e.g. linking the selling price to cost of raw materials (price escalation clause) - Risk acceptance

e.g. continuing the supplies even if cost is more than selling price, to avoid black-listing

- Risk avoidance

- Reporting

Employees noticing the risks and potential risks shall bring them to the notice of unit head for appropriate risk mitigation action. Unit head, where he can not address the risks, shall report them to company management and so on to Risk Management Committee, Audit Committee and Board.

Reporting shall comply with company law, SEBI regulations and other statutes as may be applicable.

Policy on Determining Materiality

Premier Explosives Limited

Policy to Determine the Material Events

- SCOPE AND PURPOSE

The Securities Exchange Board of India, on 2nd September, 2015 had released SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (Regulations, 2015). By virtue of the said Regulations, 2015, Premier Explosives Limited (the “Company”) has framed this policy, as required under Regulation 30 of Regulations 2015, to determine the Materiality of Events or information, for the purpose of proper, sufficient and timely disclosure of the same to the Stock Exchange(s).

This Policy will be applicable to the Company effective December 1, 2015. - APPLICABILITY

This policy shall be applicable to all the events in the Company, as and when they fall under the criteria enumerated in the policy. - DEFINITIONS

“Company” shall mean Premier Explosives Limited

“Compliance Officer” shall mean the Company Secretary of the Company;

“Designated securities” means- Specified securities;

- Non‐convertible debt securities;

- Non‐convertible redeemable preference shares;

- Perpetual debt instrument;

- Perpetual non‐cumulative preference shares;

- Indian Depository Receipts;

- Securitised debt instruments;

- Units issued by mutual funds; and

- Any other securities as may be specified by the Securities Exchange Board of India;

- Chief Executive Officer (CEO)/ Managing Director (MD)/ Manager

- Whole‐time Director (WTD)

- Chief Financial Officer (CFO)

- Company Secretary (CS)

“Market Sensitive Information” shall mean information concerning the Company that a reasonable person would expect, to have a material effect, on the price or value of its securities; or information which causes the market to maintain the price of security at or about its current level when it would otherwise be expected to move materially in a particular direction, given price movements in the market generally or in the Company’s sector.

“Officer” means as assigned to the term in clause (59) of Section 2 of the Companies Act, 2013 and shall include Promoters of the Company.

"Promoter" means as assigned to the term in clause (za) of sub‐regulation (1) of regulation 2 of the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009;

“Securities” means such securities as defined in section 2(h) of Securities Contracts (Regulation) Act, 1956;

"Stock exchange" means the stock exchanges where the Securities of the Company are listed;

“Specified securities” means ‘equity shares’ and ‘convertible securities’ as defined under clause (zj) of sub‐regulation (1) of regulation 2 of the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2009;

“Subsidiary” means a subsidiary as defined under sub‐section (87) of section 2 of the Companies Act, 2013;

- KEY PRINCIPLES IN DETERMINING MATERIALITY

The Regulations, 2015 divide the events that need to be disclosed broadly in two categories. The events that have to be necessarily disclosed without applying any test of materiality are Indicated in Para A of Part A of Schedule III of the Listing Regulation. Para B of Part A of Schedule III indicates the events that should be disclosed by the listed entity, if considered material.

- EVENTS WHICH ARE DEEMED TO BE MATERIAL AND SHALL BE DISCLOSED.

These are the events that have to be necessarily disclosed without applying any test of materiality;-

- Acquisition(s) (including agreement to acquire), Scheme of Arrangement (amalgamation/ merger/ demerger/restructuring), or sale or disposal of any unit(s), division(s) or subsidiary of the Company or any other restructuring:

- Issuance or forfeiture of securities, split or consolidation of shares, buyback of securities, any restriction on transferability of securities or alteration in terms or structure of existing securities including forfeiture, reissue of forfeited securities, alteration of calls, redemption of securities etc.;

- Revision in Rating(s);

- Outcome of Meetings of the Board of the Company held to consider the

following:

- declaration of dividends and/or cash bonuses recommended or declared or the decision to pass any dividend and the date on which dividend shall be paid/dispatched;

- any cancellation of dividend with reasons thereof;

- the decision on buyback of securities;

- the decision with respect to fund raising proposed to be undertaken

- increase in capital by issue of bonus shares through capitalization including the date on which such bonus shares shall be credited/dispatched;

- reissue of forfeited shares or securities, or the issue of shares or securities held in reserve for future issue or the creation in any form or manner of new shares or securities or any other rights, privileges or benefits to subscribe to;

- short particulars of any other alterations of capital, including calls;

- financial results;

- Decision on voluntary delisting by the Company from stock exchange(s).

- Agreements (viz. shareholder agreement(s), joint venture agreement(s), family settlement agreement(s) (to the extent that it impacts management and control of the Company), agreement(s)/treaty (ies)/contract(s) with media companies) which are binding and not in normal course of business, revision(s) or amendment(s) and termination(s) thereof;

- Fraud/defaults by promoter or Key Managerial Personnel or by Company or arrest of Key Managerial Personnel or promoter;

- Change in Directors, Key Managerial Personnel, auditor and Compliance Officer;

- Appointment or discontinuation of share transfer agent;

- Corporate debt restructuring;

- One time settlement with a bank;

- Reference to BIFR and winding‐up petition filed by any party / creditors;

- Issuance of Notices, call letters, resolutions and circulars sent to shareholders, debenture holders or creditors or any class of them or advertised in the media by the Company;

- Proceedings of Annual and Extraordinary General Meetings of the Company;

- Amendments to memorandum and articles of association of Company, in brief;

- Schedule of analyst or institutional investor meet and presentations on financial results made by the Company to analysts or institutional investors;

- THE FOLLOWING EVENTS SHALL BE CONSIDERED MATERIAL SUBJECT TO THE

APPLICATION OF THE GUIDELINES MENTIONED IN CLAUSE (C) BELOW;-

- Commencement or any postponement in the date of commencement of commercial production or commercial operations of any unit/division;

- Change in the general character or nature of business brought about by arrangements for strategic, technical, manufacturing, or marketing tie‐up, adoption of new lines of business or closure of operations of any unit/division (entirety or piecemeal);

- Capacity addition or product launch;

- Awarding, bagging/ receiving, amendment or termination of awarded/bagged orders/contracts not in the normal course of business;

- Agreements (viz. loan agreement(s) (as a borrower) or any other agreement(s) which are binding and not in normal course of business) and revision(s) or amendment(s) or termination(s) thereof;

- Disruption of operations of any one or more units or division of the Company due to natural calamity (earthquake, flood, fire etc.), force majeure or events such as strikes, lockouts etc.;

- Effect(s) arising out of change in the regulatory framework applicable to the Company;

- Litigation(s) / dispute(s) / regulatory action(s) with impact;

- Fraud/defaults etc. by directors (other than key managerial personnel) or employees of Company;

- Options to purchase securities including any ESOP/ESPS Scheme;

- Giving of guarantees or indemnity or becoming a surety for any third party;

- Granting, withdrawal, surrender, cancellation or suspension of key licenses or regulatory approvals.

- THE EVENTS AS ENUMERATED IN CLAUSE (B) ABOVE SHALL BE CONSIDERED MATERIAL

ONLY ON APPLICATION OF THE FOLLOWING GUIDELINES-

- the omission of an event or information, which is likely to result in discontinuity or alteration of event or information already available publicly; or

- the omission of an event or information is likely to result in significant market reaction if the said omission came to light at a later date; or

- In case where the criteria specified in sub‐clauses (a) and (b) are not applicable, an event/information may be treated as being material if in the opinion of the board of directors of Company, the event / information is considered material.

- ANY OTHER INFORMATION/EVENT VIZ. MAJOR DEVELOPMENT THAT IS LIKELY TO AFFECT

BUSINESS:

Events/ Information that may include but are not restricted to -

- Emergence of new technologies;

- Expiry of patents;

- Any change of accounting policy that may have a significant impact on the accounts, etc. and brief details thereof;

- Any other information which is exclusively known to the Company which may be necessary to enable the holders of securities of the Company to appraise its position and to avoid the establishment of a false market in such securities;

- Market Sensitive Information;

- Any event which in the view of the Board is material.

- EVENTS WHICH ARE DEEMED TO BE MATERIAL AND SHALL BE DISCLOSED.

- ADMINISTRATIVE MEASURES

Unless otherwise decided by the Board of Directors, the Chairman & Managing Director and Chief Financial Officer for the time being of the Company shall be authorized for the purpose of determining materiality of an event or information as enumerated in sub‐clauses B and D of Clause 4 on the basis of the Guidelines mentioned in sub‐clause C of clause 4 of the Policy, for making disclosures to the stock exchange.

The contact details of the Chairman and Managing Director and the Chief Financial Officer shall be disclosed to the stock exchange and also, be disseminated on the Company’s website.

The dissemination of such information or event shall be done to the stock exchange under the signature of the CMD or the Chief Financial Officer or the Whole time Directors or the Company Secretary of the Company.

- INTERPRETATION

In any circumstance where the terms of this Policy differ from any existing or newly enacted law, rule, regulation or standard governing the Company, the law, rule, regulation or standard will take precedence over this Policy until such time as this Policy is changed to conform to the law, rule, regulation or standard.

- GUIDANCE ON WHEN AN EVENT/INFORMATION IS DEEMED TO BE OCCURRED

- The events/information shall be said to have occurred upon receipt of approval of Board of Directors e.g. further issue of capital by rights issuance and in certain events/information after receipt of approval of both i.e. Board of Directors and Shareholders;

- The events/ information that may be of price sensitive nature such as declaration of dividends etc., on receipt of approval of the event by the Board of Directors, pending Shareholder’s approval;

- In the events/information such as natural calamities, disruption etc. can be said to have occurred when the Company becomes aware of the events/information, or as soon as, an officer of the entity has, or ought to have reasonably come into possession of the information in the course of the performance of his duties;

- DISCLOSURE

The Chairman & Managing Director and CFO shall observe the following for proper and timely disclosure of any material events/ information as defined hereon:

- For determining materiality of any event/transaction, reference is to be made to this Policy and the Regulations.

- Disclosure of the events enumerated in Clause 4(A)(4) above shall be made within 30 minutes of the conclusion of the Board Meeting at which such events were discussed along with the time of commencement and conclusion of the meeting.

- All other events mentioned under Clause 4(A) and (B) above, other than those mentioned in the foregoing clause shall be disclosed by the Company as soon as reasonably possible but not later than 24 hours from the occurrence of a particular event.

- The details with regard to any fraud/ default by Directors, Promoter or KMP or by the Company or arrest of any Promoter or KMP shall be disclosed at the time of unearthing of the fraud or occurrence of default/ arrest.

- The Stock Exchange shall also be intimated further details regarding the same including actual amount of fraud/ default, actual impact of such fraud/ default on the Company and its financials and corrective measures taken thereon.

- Disclosure of any material development shall be made on a regular basis of any event, till the time the event is resolved/ closed.

- The disclosure shall be made with respect to the Company, its KMPs, or Promoters, or ultimate person in control at the time of becoming party to any litigation assessment, adjudication, arbitration or dispute in conciliation proceedings or upon institution of any litigation, assessment, adjudication, arbitration or dispute including any ad interim or interim orders passed against or in favour of the Company, the outcome of which can reasonably be expected to have an impact.

- The Stock Exchange shall also be regularly intimated about details of any change in the status and/ or any development thereon till the litigation or dispute is concluded and/ or is resolved.

- All the disclosures made to the Stock Exchange under this Policy shall also be disclosed on the Website of the Company and the same shall be hosted for a minimum period of five years and thereafter as per the preservation of documents and archival policy as adopted by the Company

- The Company shall also disclose all the events or information with respect to its Subsidiaries which are material for the Company.

- Company shall provide specific and adequate reply to all queries raised by stock exchange(s) with respect to any events or information:

- Company may on its own initiative also, confirm or deny any reported event or information to stock exchange(s).

- In case where an event occurs or information is available with the Company, which has not been indicated above, but which may have material effect on it, the Company shall make adequate disclosures in regard thereof.

- AUTHORITY TO MAKE ALTERATIONS

The Board of Directors are authorized to make such alterations to this Policy as considered appropriate, subject, however, to the condition that such alterations shall not be inconsistent with the provisions of the Regulations, 2015 and any amendment thereto from time to time.

Policy on Preservation of Documents

PREMIER EXPLOSIVES LIMITED

POLICY ON PRESERVATION OF DOCUMENTS AND ARCHIVAL OF DOCUMENTS IN ITS

WEBSITE

-

Purpose and Scope

The policy on preservation and archival of documents is mandated by the provisions of Regulation 9 of Chapter III of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“LODR”). With this policy, the Company intends to safeguard significant documents and preserve them to ensure durability of documents including documents in electronic form.

This policy may be reviewed by the Board of Directors and amendments made, to comply with any requirements under any statute or regulation, from time to time. - Classification of documents-

- Permanent Preservation:

- All documents filed with Ministry of Corporate Affairs.

- All documents filed with SEBI / BSE / NSE.

- All documents filed with Tax Authorities in Income Tax, Service Tax, VAT & similar tax authorities.

- All permits, licenses, authorization from any statutory authorities.

- Audited Accounts

- Any other document required to be preserved permanently under any law / statute.

- Preservation for 8 years:

- Bank, cash vouchers, payment vouchers, warrants

- Bank statements

- Purchase bills

- Sales invoices, Debit / credit notes, etc.

- Accounting records

- Any documents related to correspondence with Customs at CFS

- Any other documents required to be preserved for 8 years under any law /statute.

- Other Documents maybe stored and preserved in physical form/ electronic form, after the completion of the relevant transactions, for such period as may be required, in each case.

- Permanent Preservation:

- Correspondence and Internal Memoranda

General Principle: Most correspondence and internal memoranda shall be retained for the same period as the document they pertain to or support.

- Those pertaining to routine matters and having no significant, lasting consequences may be discarded within two years.

- Those pertaining to non-routine matters or having significant lasting consequences should be generally preserved permanently.

- Electronic Documents including email retention and back up

- Electronic Mail:

- All e-mail – from internal and external sources to be deleted after they cease to be of current use, depending on the subject matter.

- Employees should keep emails related to current business issues.

- I.T Department would archive email for 7 years on email archival server after the employees have deleted it, post which time the email will be permanently deleted.

- Employee will not store or transfer the Company related emails on non-work related computers except as necessary or appropriate with due approvals from the respective Head of Department.

- Employees will take care not to send confidential/proprietary information to outside sources

- Any e-mail deemed vital by the Employees to the performance of their jobs should be copied to the employee’s specific folder and/or printed and stored in the employees workplace.

- Web page files

- All such events / information hosted on the Company’s website shall be retained for a period of 5 years as specified in SEBI’s LODR Regulations, 2015.

- After the initial period of 5 years, documents / information (except documents of permanent nature) shall be archived by the I.T. department for a further period of 3 years.

- Documents of permanent nature, uploaded on the Company’s website, shall be archived by the I.T. Department.

- Electronic Mail:

Responsibility:

The responsibility for preservation of the documents

will be on the concerned department Heads. Head – IT will be responsible for all the

documents preserved in electronic mode.

Policy On Material Subsidiaries

Introduction

The Board of Directors (the “Board”) of

Premier Explosives Limited (the “Company”) has adopted the following policy and procedures

with regard to Material Subsidiaries, which may be reviewed and amend by the Board from time

to time.

Policy objective

This policy is framed to enable determination of Material Subsidiaries of the Company and to

provide governance framework for such identified subsidiaries, as per the requirements of

SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Definitions

All the words and expressions used in this Policy, unless defined hereafter, shall have meaning respectively assigned to them under the Listing Agreement and in the absence of its definition or explanation therein, as per the Companies Act, 2013 (“Act”) and the Rules, Notifications and Circulars made/issued thereunder, as amended, from time to time.

“Audit Committee” means the Audit Committee constituted by the Board of Directors of the Company, from time to time, under SEBI (LODR) Regulation 2015 and the Companies Act, 2013.

“Board of Directors” or “Board” means the Board of Directors of Premier Explosives Limited, as constituted from time to time.

“Company” means a company incorporated under the Companies Act, 2013 or under any previous company law.

“Independent Director” means a director of the Company, not being a whole time director and who is neither a promoter nor belongs to the promoter group of the Company and who satisfies other criteria for independence under the Companies Act, 2013 and SEBI (LODR) Regulations 2015

“Policy” means Policy on Material Subsidiaries.

“Material Unlisted Indian Subsidiary” shall mean a Material Subsidiary which is incorporated in India and is not listed on the Indian stock exchanges.

“Significant Transaction or Arrangement” shall mean any individual transaction or arrangement that exceeds or is likely to exceed ten percent of the total revenues or total expenses or total assets or total liabilities, as the case may be, of the material unlisted subsidiary for the immediately preceding accounting year.

“Subsidiary” shall be as defined under the Companies Act, 2013 and the Rules made thereunder.

Policy

- Material unlisted Indian subsidiary shall mean an unlisted subsidiary, incorporated in India, whose income or net worth (i.e. paid up capital and free reserves) exceeds twenty percent of the consolidated income or net worth respectively of the Company in the immediately preceding accounting year.

- One Independent Director of the Company shall be a director on the Board of the material unlisted Indian subsidiary company.

- The Audit Committee of the Company shall review the financial statements, in particular, the investments made by all the unlisted subsidiary companies on quarterly basis.

- The minutes of the Board Meetings of all the unlisted subsidiary companies shall be placed before the Board of the Company on quarterly basis.

- The management shall on quarterly basis bring to the attention of the Board of Directors of the Company, a statement of all Significant Transactions and Arrangements entered into by the unlisted subsidiary companies.

- The Company shall not without passing a special resolution in its general meeting: (i) dispose shares in Material Subsidiaries that reduces its shareholding (either on its own or together with other subsidiaries) to less than fifty percent ; or

(ii) cease the exercise of control over the subsidiary; or

(iii) sell, dispose or lease the assets amounting to more than twenty percent of the assets of the material subsidiary.

Provided that no such prior approval of shareholders by way of special resolution in general meeting will be required if the sale, disposal, lease is made pursuant to a scheme of arrangement duly approved by a Court/Tribunal.

Dissemination

Pursuant to Rule 46 of SEBI (LODR) Regulations 2015, this Policy and any amendment thereto

shall be posted on the website of the Company and a web link thereto shall be provided in the

Annual Report.

Limitation and amendment

In the event of any conflict between the Policy provisions and Statutory provisions

(Companies Act, other Acts, Listing Agreement, other Statutory rules, etc.) the latter shall

prevail over this Policy. Any subsequent amendments and modifications in the statutory

provisions in this regard shall automatically apply to this Policy.

Policy review

This Policy shall be subject to review as may be deemed necessary and in accordance with

regulatory amendments.

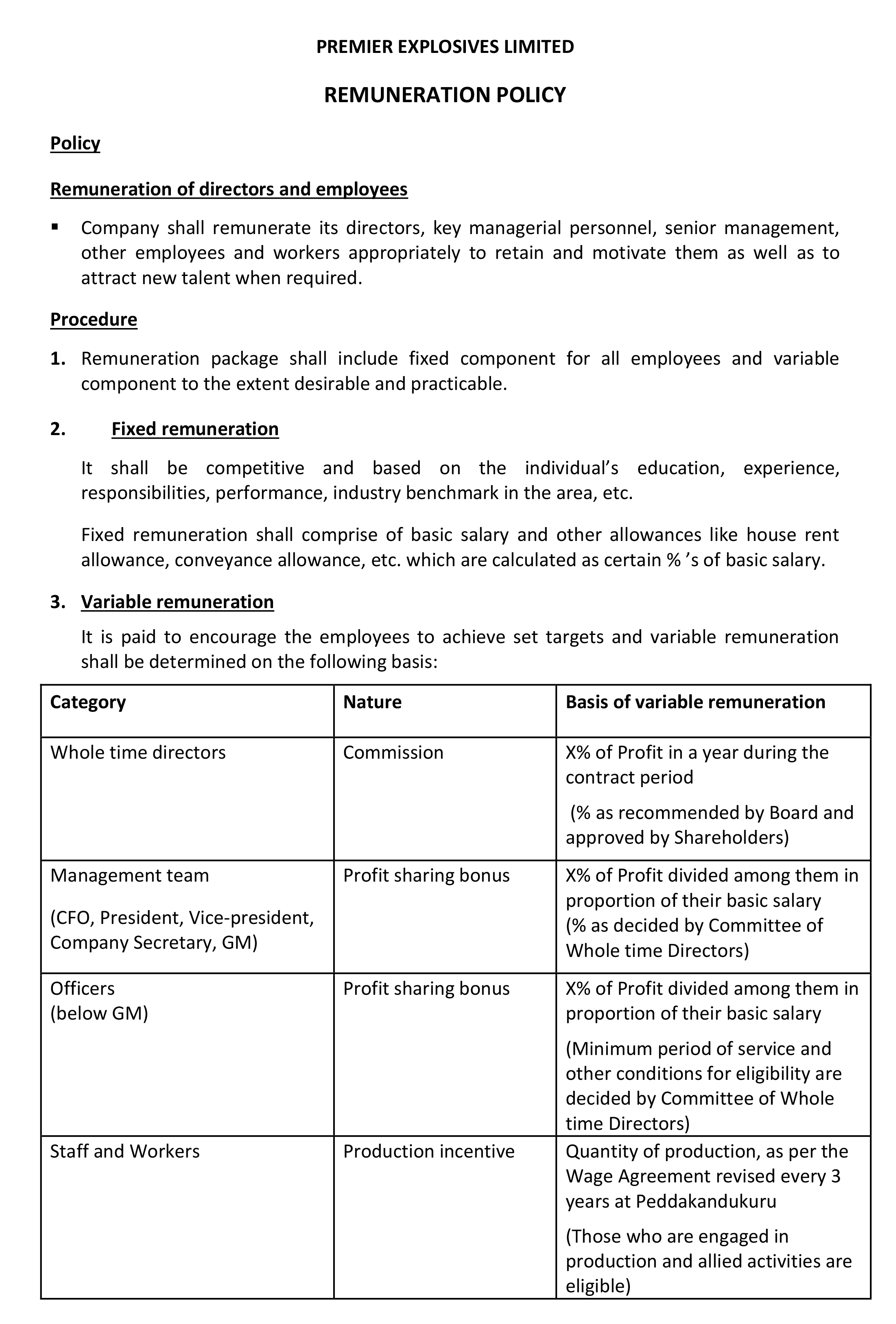

Remuneration Policy